My content may contain 3rd party affiliate links for products I use and love. If you take action (i.e. subscribe or purchase) after clicking one of these links, I'll earn some coffee money ☕ which I promise to drink while creating more helpful content.

[lwptoc]

Introduction

As I look back, the last 40 years has been an ever-shifting economic landscape. A lot of us are struggling more and more with the rising cost of living. Inflation is eroding our purchasing power. What used to be straightforward budget management is now a formidable challenge. If you're feeling the pinch, you're not alone.

The question for us isn't just how to survive these tough economic times. We need to find ways to thrive. In this article, I'll show you some practical strategies on how to supplement income during inflation.

By understanding what has happened over the last 40 years and recognizing the potential available through side hustles and small businesses, you can unlock new avenues for financial stability and growth. Together, let’s make sure we're not just getting by, but getting ahead.

The Economic Landscape Over the Last 40 Years

Forty years ago, managing a budget was simpler. Prices were stable, and our earnings went further. But over the decades, this has changed drastically. Inflation has been a constant pressure, subtly but steadily eating away at our buying power.

Let's look at a relatable example: the price of a Big Mac. In 1986, it cost $1.60. Today, you'd pay almost $5.99 for the same burger. That's nearly four times more. What does this tell us? It's a clear sign of how much more expensive our basic needs have become.

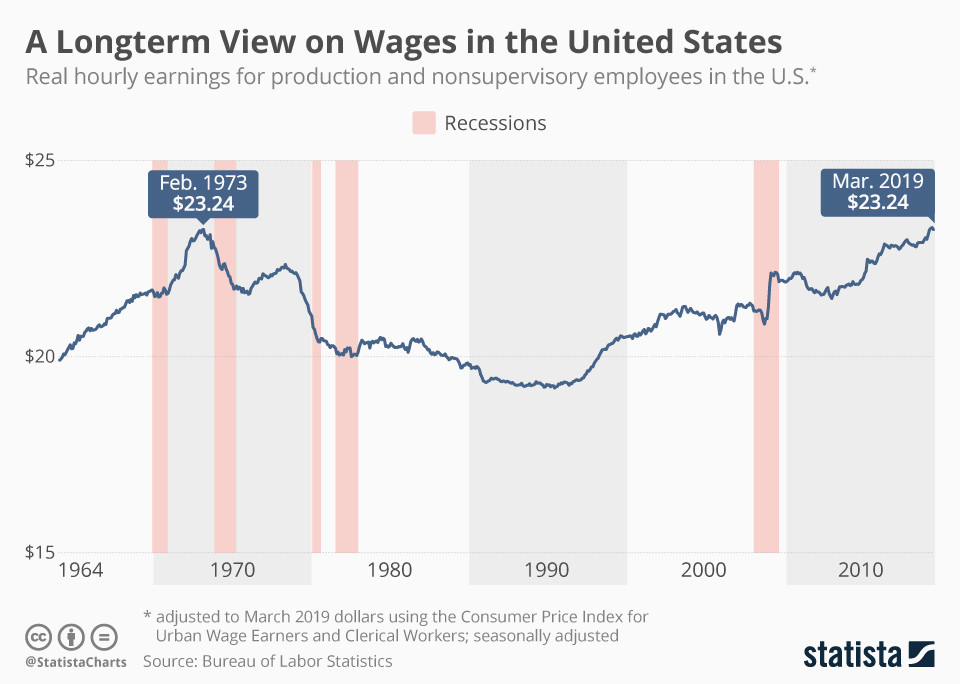

Meanwhile, wages haven't kept up with these price increases. According to data from Statista, the average hourly wage in 1986 was $6.20. Fast forward to today, and it's about $19. This might seem like a significant increase, but not when you compare it to how much more we have to pay for everything.

In 1986, you could earn enough to buy a Big Mac in about 15 minutes. Now, it takes about 18 minutes. 3 minutes doesn't sound like much, but that's a 20% increase in how long you have to work to pay for the same basic item. That's a small sample of a broader trend where our wages don't stretch as far as they used to.

This financial squeeze isn't just about numbers; it affects real lives. More families now rely on dual incomes or even multiple jobs just to keep up. As we face these realities, it's clear that the old ways of managing our finances are no longer enough. We need to learn how to supplement income during inflation or we're going to keep falling further behind.

Current Economic Realities

Today's economic landscape is more challenging than ever. Inflation continues to rise, wage growth hasn't kept pace, and there's a widening gap between earnings and the cost of living. This has significant consequences for our daily lives and long-term financial planning.

These days, most families depend on multiple sources of income. Many households require both partners to work full-time jobs, and it's not unusual for folks to take on additional part-time work or side gigs on top of that. It's harder now than ever to sustain a comfortable lifestyle on a single income.

More important than the numbers is the human element to these economic changes. The stress of financial instability strains relationships, impacts mental health, and reduces the quality of life. Many men find themselves working longer hours, sacrificing personal time and well-being, just to maintain an ever-more-elusive financial security.

For those of us looking ahead to retirement, the situation can feel particularly daunting. Our savings is probably missing a comma. We're faced with the prospect of working well into what should be retirement years not by choice but by necessity. The dream of a leisurely retirement is being replaced by the reality of ongoing work, as savings struggle to keep up with inflation.

In this context, simply sticking to traditional financial strategies is no longer sufficient. We need to adapt to these realities by exploring new ways to supplement income during inflation and safeguard our financial future.

The Hidden Costs of Stagnation

The effects of wage stagnation go beyond the challenge of covering daily expenses. Over time, stagnant wages chipped away at our ability to save, invest, and plan for the future. This in turn leads to hidden costs that affect our overall well-being.

One of these hidden costs is the loss of financial security. As the cost of living increases, savings that once seemed adequate for retirement are now insufficient. This can lead to anxiety about the future, as the cushion we hoped to rely on grows thinner with each passing year.

A recent article in Kiplinger revealed most people believe they now need about $1.6 million to retire comfortably. This is a 53% increase just from 2020. On top of that, the average American has a smaller retirement account balance this year than they did last year. Oh yeah: and more debt, too.

Another cost is the missed opportunity for financial growth. When all your income goes into covering basic needs, there isn't much left to invest in opportunities that could multiply your wealth. You keep hearing about how the stock market, cryptos and other investment vehicles are making great gains.

The problem is you aren't invested because you're using all you earn (and more) to buy that Big Mac. Or clothes for the kids. Or gas. Over the years, this results in a huge gap in wealth accumulation compared to those who can afford to invest. Literally, the rich get richer.

Furthermore, the need to work more hours or take on multiple jobs can lead to deteriorating health and less time with family and friends. This not only affects your quality of life but can also lead to higher medical bills and other expenses down the road.

Given these challenges, it's clear that finding alternative income streams is not just beneficial—it's necessary. Side hustles and small businesses offer a way to regain control over your financial future. They provide a flexible option to earn extra income, which can be used to bolster savings, reduce debt, or invest in opportunities previously out of reach.

Starting a side business also empowers you to build something that can continue to provide income even as you move into retirement, easing the transition and offering a more secure financial foundation.

Side Hustles Can Supplement Income During Inflation

Embracing a side hustle or small business is more than a temporary fix; it's a strategic move towards greater financial independence. It's how we're going to supplement income during inflation and get ahead of this whole thing. It's how we're going to find that missing comma. Here’s why starting your own venture can be a transformative step:

1. Flexibility and Control: Unlike traditional jobs, a side business offers you control over your time and the potential to earn based on performance, not just hours worked. You decide when and how much you work, aligning your business activities with your lifestyle and personal commitments.

2. Building on Passion or Expertise: Many successful side hustles start from a personal passion or professional expertise. Whether it’s woodworking, consulting, or online marketing, turning what you love or do best into a business not only makes work enjoyable but also increases the likelihood of success.

3. Financial Benefits: A side business can diversify your income sources, reducing the risk associated with relying solely on a paycheck. The additional income can help you manage living expenses, invest in your future, and accumulate wealth.

4. Growth and Learning: Running a business will be a learning experience. You’ll acquire new skills and knowledge, which further enhance your marketability and capabilities, both professionally and personally. So you're more valuable in the job market, as well.

5. Legacy and Security: Over time, your side business can grow into a significant asset. It provides not just immediate income but can also be a part of your legacy—a sustainable venture that supports you into retirement or can be passed on to family members.

Practical Steps to Get Started:

Identify Your Niche: Look at what you are passionate about, or where your expertise lies, and consider how it can solve a problem or fulfill a need.

Market Research: Understand your potential customers and competitors. This will help you find your unique selling proposition and position your business effectively.

Create a Business Plan: Outline your business goals, strategies, and financial projections. A solid plan will serve as a roadmap for your business and can be essential for securing any needed financing or partnerships.

Set Up Your Business Legally: Register your business, get the necessary licenses, and understand your tax obligations to ensure everything is set up correctly from the start.

Launch and Promote: Use digital marketing strategies to reach your audience. Build a website, leverage social media, and consider local advertising to get the word out about your new business.

Ready to take the first step towards financial freedom? Download my free book, "7 Days to a Profitable Home Business", which will help you launch a successful home business in just one week. Inside, you’ll find daily actionable steps, insights, and strategies designed to get your business off the ground quickly and effectively. Whether you're looking to supplement your income or build a lasting legacy, this book is your essential guide. [Download now and start your journey today!]

Wrapping Up

Navigating today's economic challenges requires more than perseverance; it demands a proactive approach to securing our financial future. As we've seen, the landscape has shifted dramatically over the past 40 years, with rising inflation and wage stagnation making it increasingly difficult to maintain, let alone enhance, our standard of living. It's up to us to get and stay ahead of it. For ourselves and our families.

Starting a side hustle or small business is not only about earning extra money. It's about taking control of your financial destiny and creating opportunities that weren't available to you before. It's about building resilience in an unpredictable economy.

Paving a path that leads to both immediate income and long-term financial security.

Doing what we need to do to get and stay ahead of the damage done by decades of governmental fiscal mismanagement.

The journey to a profitable home business begins with a single step. Whether it’s capitalizing on your skills, turning a hobby into a business, leveraging your professional experience, or learning a completely new skill set, the potential to improve your financial well-being is within your grasp.

So, take that step today. Equip yourself with the right knowledge, tools, and mindset to succeed. Don't just get by—get ahead. Your future self will thank you for the effort and foresight you show now.