In a time when economic stability seems more like the fevered dream of a bygone time than a current policy goal, lots of folks are wondering, “How does gold do in a recession?” As the U.S. faces an escalating debt crisis and an economy on shaky ground, it’s worth noting that the very institutions meant to safeguard our financial system—namely the Federal Reserve and Congress—have played a significant role in getting us here. Through a combination of questionable monetary policy and unchecked fiscal spending, these characters have set the stage for potential economic disaster.

So, where does gold fit into this precarious landscape? The shiny yellow stuff has long been considered a safe haven in times of economic uncertainty. But can it hold its value when the very foundations of our economy are wobbling? In this article, we’ll explore how gold has performed during past recessions, examine the pros and cons of investing in this asset, and offer expert perspectives to help you navigate these uncertain times. Whether you’re an experienced investor or just starting out, this guide aims to provide a nuanced view of the opportunities and risks involved in investing in gold during a recession.

Section 1: The Rising U.S. Debt

The U.S. Debt Situation

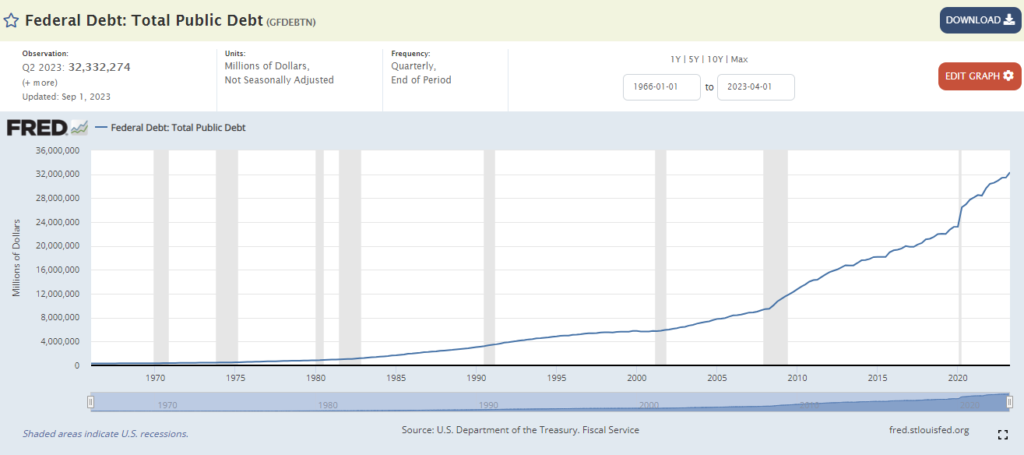

Let’s talk numbers. The U.S. is swimming in debt, and we’re talking trillions. That’s not just pocket change; it’s a real issue that could shake up our economy down the line. Here’s a chart from the St. Louis Fed showing the huge increase in the national debt since 1975. It’s scary statistics like this that first got me wondering how does gold do in a recession. This is a situation that can’t end well.

Why It Matters

So, why should you care? High debt can make borrowing more expensive for everyone, from buying a home to starting a business. And here’s the kicker: the folks in charge, like the Federal Reserve and Congress, have had a hand in this. They’ve been spending and borrowing without enough foresight.

The Potential Fallout

If we don’t get a handle on this debt, we could be looking at some serious economic problems. Jobs might become scarce, and the value of the dollar could drop. In uncertain times, having a safety net like gold could be a smart move.

Section 2: Why Gold?

Alright, let’s dive a bit deeper and try to answer how does gold do in a recession. The next section we’re tackling is about the Federal Reserve’s role in the economy. Now, the Fed is, supposedly, like the economy’s babysitter. It’s supposed to keep things steady, but sometimes, it messes up—big time.

- Interest Rates: The Fed sets interest rates, which is the price of borrowing money. When they keep rates too low for too long, people go on a borrowing spree. It’s like a sugar rush; it feels good for a bit, but then comes the crash. That’s what we’ve been doing since 2008.

- Quantitative Easing: This is a fancy term for the Fed printing more money. Sounds cool, right? But here’s the catch: it leads to inflation. Imagine having more money but everything costs more too. Not so fun anymore.

- Regulation: The Fed is supposed to keep an eye on banks to make sure they’re not doing anything sketchy. But sometimes, they miss the red flags or choose to ignore them. And we all know what happens when the babysitter isn’t paying attention.

- Political Influence: The Fed is supposed to be independent, but let’s be real, they can be swayed by politics. When that happens, they might make decisions that are good for some politicians but bad for regular folks like us.

So, why does all this matter? Because when the Fed messes up, it’s not just a headline in the news. It affects jobs, savings, and even the global economy. It’s like a ripple effect, and sometimes, those ripples turn into waves that are hard to surf.

Section 3: Pros of Investing in Gold

So, you’re probably wondering, “With all this economic chaos, what’s a smart move?”

Good question: I’m glad you asked.

Hedge Against Inflation

Inflation is a thief that chips away at your money’s value. But guess what? Gold doesn’t do that.

When the cost of living goes up, so does the value of gold. It’s like having a financial shield that inflation can’t penetrate. So, inflation is basically when the cost of goods and services goes up, right? That means the money you’ve stashed away buys you less stuff over time. It’s like you’re losing money without even spending it. Ouch!

Now, here’s where gold shines (pun intended). Gold has this knack for holding its value, even when everything else is going haywire. It’s like the superhero of the financial world, swooping in to save the day when inflation tries to rob you. You see, gold prices often move in the opposite direction of the currency’s value. So, when the dollar’s buying power is going down the drain, the value of gold usually goes up. It’s like a financial seesaw. One side goes down, the other goes up.

This chart from GoldPriceForecast.com shows how closely correlated gold prices and inflation are:

In simpler terms, investing in gold is like having a financial safety net. It’s a way to protect the purchasing power of your money when inflation is doing its best to erode it away. Gold is like that reliable friend who will answer the phone if you call needing bail money at 3AM.

Currency Decline

Alright, let’s talk about the elephant in the room: currency decline. You know, it’s like that annoying friend who overstays their welcome at a party. Currency decline is when the value of a country’s money starts to drop compared to other currencies. Imagine you’re holding a dollar bill, and suddenly it’s not worth a full dollar anymore.

Maybe it’s only worth 90 cents compared to other currencies. That’s a bummer, especially if you’re planning to travel or buy stuff from other countries. Everything just got more expensive for you, even though the price tags haven’t changed.

Now, why should you care? Well, a declining currency can be a sign that the economy’s not doing so well. It can lead to higher import costs, which can then trigger—you guessed it—inflation. And we all know inflation’s that sneaky SOB that chips away at your purchasing power. But here’s the kicker: gold doesn’t care about currency decline. It’s like that cool, independent friend who does their own thing. When a currency is losing value, gold often becomes the go-to asset because it’s globally recognized and holds its value. So, investing in gold can be like putting on financial armor against the blows of a declining currency.

How does gold do in a recession? Pretty darned well.

Cons of Investing in Precious Metals

Not Backed by Dollar

Let’s flip the gold coin and look at the other side: the cons of investing in gold. One point that often gets swept under the rug is that gold isn’t backed by the U.S. dollar anymore. Those days are long gone. So, what does that mean for you? Well, it means that investing in gold isn’t a guaranteed shield against inflation.

See, back before 1971, the value of the dollar was tied to a specific amount of gold. That’s not the case anymore. Nowadays, the dollar’s value is influenced by a whole bunch of factors like interest rates, economic policies, and how much faith people have in Uncle Sam’s ability to manage the economy. So it is possible that gold’s history of correlating positively with inflation may not continue in the future.

Volatility

Alright, let’s talk about another potential hiccup in the gold game: volatility. You might think gold is as steady as they come but hold your horses. Here’s a chart from Wikipedia showing the inflation-sdjusted price of gold since 1960. There are a lot of downs mixed in with the ups.

The price of gold can swing like a pendulum, and that can make ’em pretty risky bets in some environments. One day you’re riding high, and the next, you’re wondering what hit you.

Why’s that? Well, gold prices are influenced by a whole lot of things—global events, economic indicators, and even market sentiment. So, if you’re not keen on rollercoasters, gold might not be the ride for you in all seasons, except as a small hedge.

Lackluster Returns

Let’s take a trip down memory lane, back to 1975. Why? Because that’s when Americans could legally own gold again, and it’s a good starting point to see how gold stacks up against other investments. Now, gold has had its moments of glory, no doubt. But if you compare it to, say, the stock market or real estate, it’s a bit of a mixed bag.

The S&P 500, for instance, has generally outperformed gold in the long run. We’re talking about an average annual return of around 10% for stocks versus approximately 7-8% for gold. Real estate? Well, it’s not just about the house; it’s about the land, the location, and a bunch of other factors. But generally speaking, real estate has also been a solid bet, especially if you’re in it for the long haul.

So, what’s the takeaway? Gold is decent, but it’s not the end-all-be-all. It’s like the supporting actor who steals some scenes but isn’t taking home the Oscar.

As a long-term investment, again gold is better viewed as a hedge than a significant holding.

Conclusion: How Does Gold Do in a Recession?

Alright, let’s wrap this up. Look, in my not-so-humble opinion, the writing’s on the wall. Between the skyrocketing U.S. debt and the questionable decisions from the Fed and Congress, we’re heading into some choppy financial waters.

So, what’s the game plan? Gold, my friends. And Bitcoin, too, but that’s another article.

Gold is the lifeboat you want when the financial Titanic starts taking on water. It’s not just a shiny metal; it’s a hedge against inflation and currency decline. And let’s be real, with the way things are going, those are two monsters we’ll likely have to face sooner rather than later.

I get it; gold has its downsides. It’s not backed by the dollar, and it can be as volatile as a cat on a hot tin roof. But when you weigh the pros and cons, especially in today’s economic climate, gold starts looking like a pretty solid bet.

So, if you’re asking me, now’s the time to go heavy on gold. Not 100%, mind you, but a significant chunk of your portfolio? Absolutely. Because when the financial storm hits, you’ll be glad you have that golden umbrella.

Sources

- chicagofed.org – Past and Future Effects of the Recent Monetary Policy

- wharton.upenn.edu – Why Presidential Influence Over Monetary Policy Should be Checked

- cfr.org – The National Debt Dilemma

- cfr.org – What Happens When the U.S. Hits Its Debt Ceiling?

- forbes.com – 5 Consequences Of US Debt At $50 Trillion

Where Does the Money Come From?

Some of us who are still looking for that comma that’s missing from our portfolio need to increase our cash flow so we can afford to invest or at least invest more.

One way we’re doing that is by running a side business. We take the profits from that and plow it into investments to get our portfolio where they ought to be.

If you could use an extra couple thousand to throw at your investments every month, I wrote a short book, 7 Days to a Profitable Home Business, which goes over how to start and begin to build your own home business. You can get a free copy by CLICKING HERE.